What is a roll-up strategy?

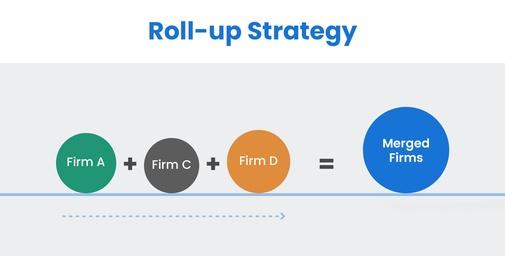

A roll-up strategy is a focused acquisition strategy that involves the acquisition of multiple smaller companies (sometimes referred to as ‘bolt-on acquisitions).

The roll-up strategy tends to be more common in industries that are fragmented but can happen anywhere that these bolt-on acquisition opportunities present themselves.

The end goal of a roll-up strategy is a company of much larger value that is more than the sum of its parts.

A roll-up strategy doesn’t generate value on its own.

As Deal Room is constantly at pains to emphasize, acquisitions are complex projects that require diligent project management.

This means excellent planning, ensuring cultural and operational fit, thorough due diligence, and sound deal structure for each one of the acquisitions.

By extension, when there are many acquisitions, this workload should increase. Just because the companies are smaller, it doesn’t mean that you can take shortcuts in the process.

Economies of scale

The entity created from the roll-up strategy should enjoy economies of scale (e.g. increased buying power) well beyond any of the smaller companies that it is composed of.

Increased exposure

By virtue of being a bigger company, the entity created from the roll-up strategy will have increased exposure, giving it access to a larger audience and making it the focus of increased media attention.

Benefits of synergies

A well-executed roll-up strategy should benefit from a range of synergies that generate value at the margins. For example, shared administration and marketing costs.

Access to better opportunities (including capital)

Bigger companies, as a rule, tend to enjoy a liquidity premium that lowers their cost of capital and allows them to access opportunities (e.g. more acquisitions) than smaller companies can.